Project Overview

Strategy & Advisory

Agents

Commercialization & Growth

Web-Scraping

Green Peak Venture Partners (GPVP) manages a diversified portfolio of real estate, franchise, and operating businesses that rely heavily on continuous capital raising. While the organization generated strong deal flow, the investor acquisition and conversion process remained highly manual, fragmented across systems, and dependent on individual sales performance.

SFAI Labs partnered with GPVP leadership to design and build an AI-powered revenue intelligence platform that unifies lead generation, investor profiling, conversation analysis, and predictive scoring into a single operating system. The engagement focused on embedding AI directly into sales, marketing, and investor relations workflows.

Over a multi-phase engagement, SFAI Labs designed, engineered, and validated a production-ready AI system integrating CRM, call data, enrichment providers, and portfolio intelligence. The platform enables GPVP to prioritize high-value investors (“whales”), personalize outreach, and accelerate capital raises with measurable ROI.

The result was a scalable AI infrastructure that transforms capital raising from a relationship-driven process into a data-driven growth engine.

Key Takeaways

Data unification drives leverage

Predictive scoring improves ROI

AI amplifies sales performance

Embedded workflows ensure adoption

Feedback loops compound value

Challenge

GPVP managed multiple investor acquisition funnels across portfolio companies, each with separate tools, data sources, and manual processes. Sales teams relied on intuition and experience to prioritize leads, resulting in long sales cycles, inconsistent follow-ups, and high customer acquisition costs.

Critical challenges included fragmented CRM data, limited visibility into investor intent, low-quality lead scoring, and insufficient insight into why deals were won or lost. The organization lacked a unified system to identify and prioritize high-value investors at scale.

Strategy

SFAI Labs defined a build-first AI transformation strategy focused on creating a centralized intelligence layer across sales, marketing, and investor relations. The strategy emphasized:

Unified data ingestion from CRM, call systems, and enrichment providers

Predictive modeling for investor value and intent

Embedded analytics within existing workflows

Continuous evaluation and refinement

Tight alignment with revenue and ROI targets

The roadmap prioritized rapid validation through MVP releases while building toward a scalable enterprise platform.

Solution

We designed and built a modular AI revenue intelligence platform featuring:

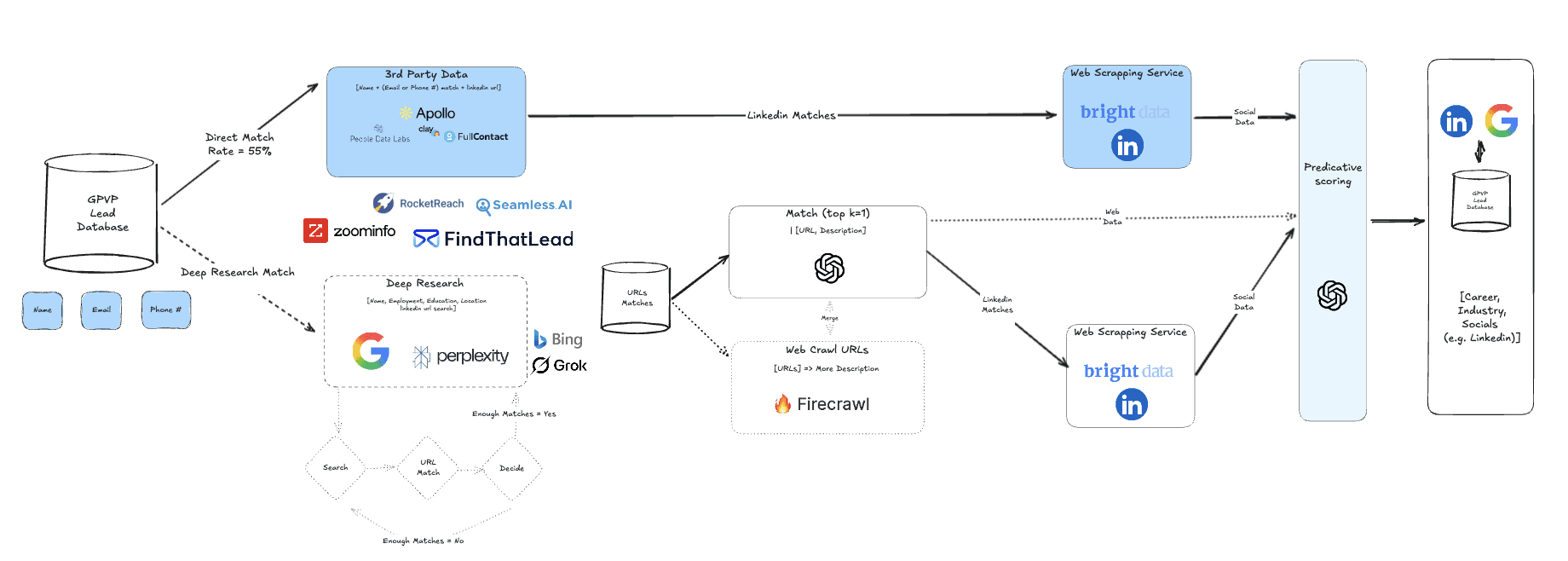

Automated lead and investor enrichment pipelines

Conversation transcription and semantic analysis

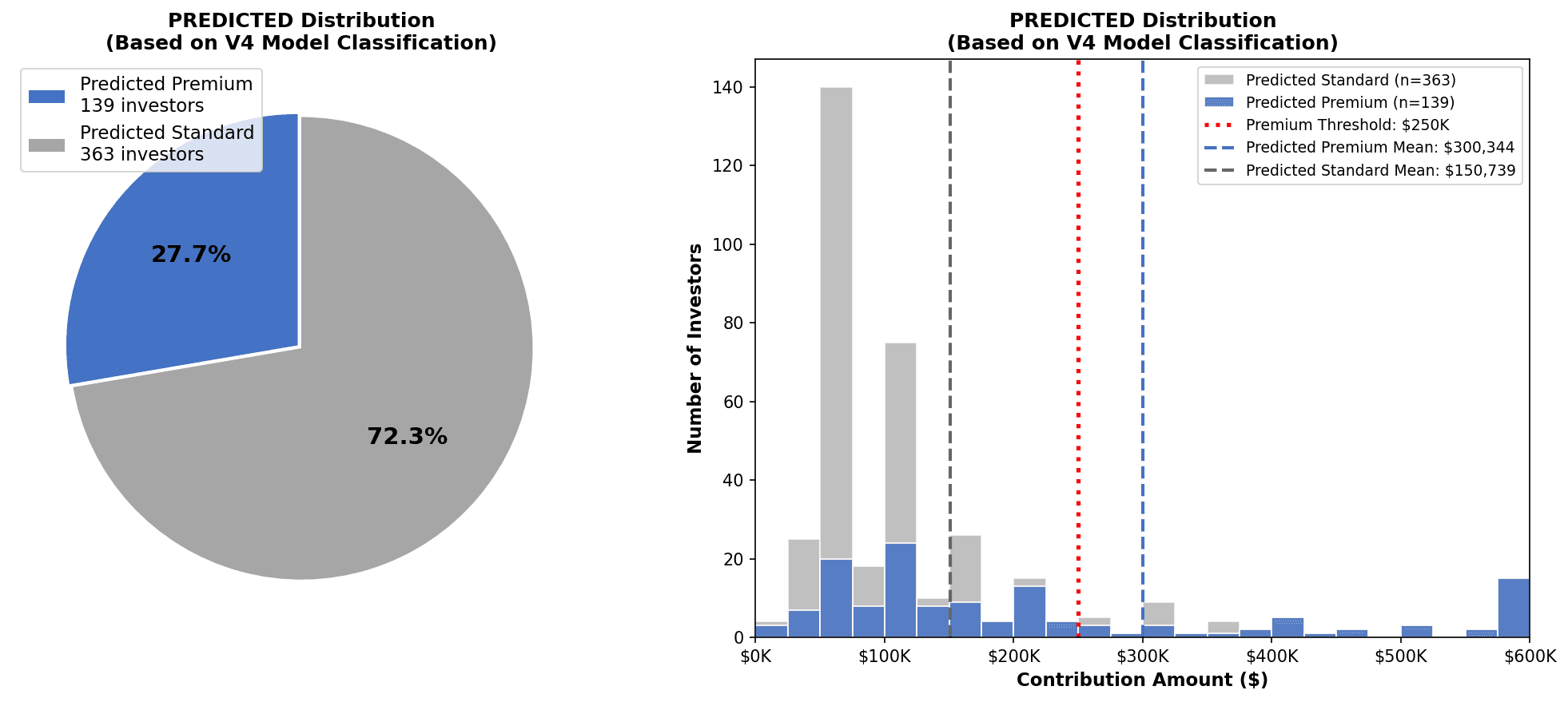

Whale classification and tier-based scoring models

Personalized outreach recommendations

CRM-native dashboards and alerts

Portfolio-wide performance analytics

The system combines machine learning classifiers, LLM-based analysis, and orchestration pipelines to surface actionable insights directly to sales and marketing teams.

Execution

Week 1–3: Workflow mapping, data audit, and system architecture

Week 4–6: Data pipelines, CRM integrations, and enrichment automation

Week 7–9: Conversation intelligence and transcription systems

Week 10–12: Predictive scoring model development and validation

Week 13–16: Platform hardening, dashboards, and deployment

Results

2× increase in high-value investor identification

Improved lead-to-close conversion rates

Reduced customer acquisition costs

Business Value

The engagement enabled GPVP to systematically identify and prioritize top investors, reduce wasted sales effort, and accelerate capital deployment. The AI platform increased revenue predictability, improved marketing efficiency, and strengthened portfolio-wide performance.

Why SFAI Labs

SFAI Labs combined AI strategy, advanced modeling, and hands-on system engineering to deliver a production-grade revenue intelligence platform. Our lab model ensured rapid experimentation, reliable deployment, and tight alignment between technical development and commercial outcomes.